Face Authentication for Remote Banking Services

Sunartek’s Face authentication system for remote banking is an API-based solution that can be integrated with a banking application either on a mobile phone or a mobile banking web server. The API is available for Android, iOS, Windows, and Linux platforms.

Face authentication banking system authenticates the identity of a person, by comparing the live image of the customer with the image stored in the bank records.

Features of Face Authentication System for Remote Banking

Secure Access

Profiles in Server

Platform Independent

Screen Conditions

Recognition with Accessories

Low Verification Time

Dual - layer Liveness Detection

Normal Bandwidth

Features

Secure Access

Profiles in Server

Platform Independent

Screen Conditions

Recognition with Accessories

Low Verification Time

Dual-layer Liveness Detection

Normal Bandwidth

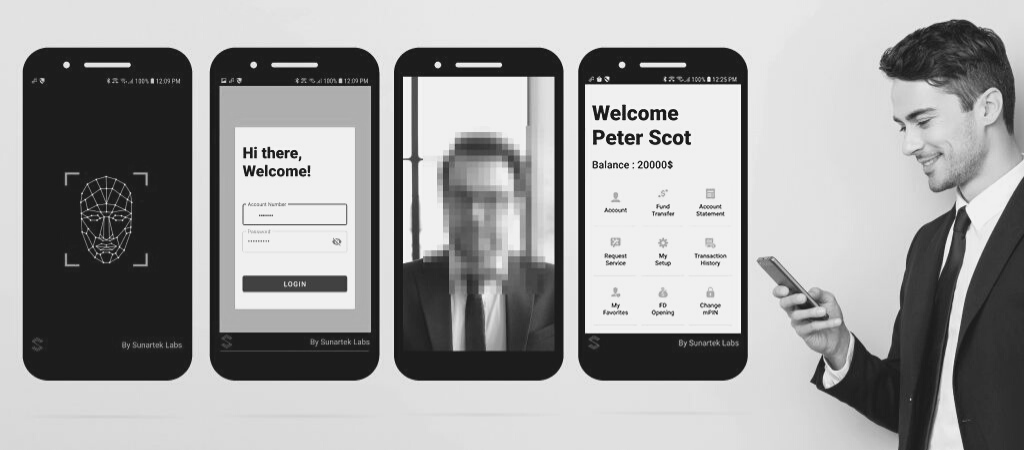

Working of Application

![]() Step 1: Application Interface

Step 1: Application Interface

![]() Step 2: Login Page

Step 2: Login Page

![]() Step 3: Once the login is successful, the camera starts loading

Step 3: Once the login is successful, the camera starts loading

![]() Step 4: Face Verification

Step 4: Face Verification

![]() Step 5: Home Page

Step 5: Home Page

![]() Step 1:

Step 1:

Application Interface![]() Step 2:

Step 2:

Login Page![]() Step 3:

Step 3:

Camera starts loading![]() Step 4:

Step 4:

Face Verification![]() Step 5:

Step 5:

Home Page

- The API captures live pictures of the user utilizing the in-built cameras on the mobile phone, laptop or web camera. The captured live image is thereby transmitted to the authentication server by using a secure internet connection.

- The authentication server checks this image against pictures of the user that was submitted when the account was opened. Hence, if a positive match is found, the authentication is successful. While in case of a negative match, the session is terminated.

- Precisely, conventional facial recognition algorithms on mobile phones, stores customers’ facial profile on the phone itself. Malicious users can bypass the mobile’s security and get access to the banking application. whereas, Sunartek’s Facial Recognition System works by comparing the live images of the customer with the images in the bank’s records in real-time. Even if the security of the mobile is compromised, unless the customer is present in front of the camera, the authentication server at the bank will not allow access to the banking application.

- Since the initiation of the digital revolution, facial recognition has been attaining prominence over touch & type-based communications due to the feasibility it offers without negotiating on the security of transactions.

- Integrating biometric facial recognition with banking software presents a robust and secure alternative to password-based authentication systems.

- Traditional methods like using passwords come with a rather serious limitation. People create passwords based on what they know. So, it is easy for a hacker to employ several tactics to crack the password. Another major flaw is that people can have too many passwords, for example, social media accounts, emails, and e-wallets as well.

- Generating a complex password can make it convenient to forget and when a banking customer demands for a provisional code through email to reset it, then a hacker can capture the inbox.

- Utilizing facial recognition indicates that the banking customer only has a ‘face’ as an identity which can permit them to access to all their bank accounts.

- Liveness Detection: It prevents hackers from using a picture of the customer for impersonation purposes.

- Convenient & secure access: The recognition system also allows customers to access their bank accounts from computers and mobile phones.